January is a month of intense observation at the Federal Reserve. For the small business owner, it’s the time when we see whether the momentum of the holiday quarter was a sustainable engine or just a seasonal high.

As of January 26, 2026, the data points trickling in from the Fed and its partner agencies suggest a complex "neutral" zone. We are seeing a tug-of-war between a surprisingly resilient consumer base and an inflation rate that refuse to complete its journey back to the 2% target. It stands at 2.7% today - Jan 26th. For those managing payroll and capital expenses, the message is clear: aggressive rate cuts is on a temporary hiatus.

What the data says on Resilience vs. Reality

The start of 2026 has been marked by a significant "data lag" following the government shutdown disruptions of late 2025. This has left the Federal Reserve in a "wait-and-see" posture, but the signals we do have are telling a story of a robust, if slightly overheated, economy.

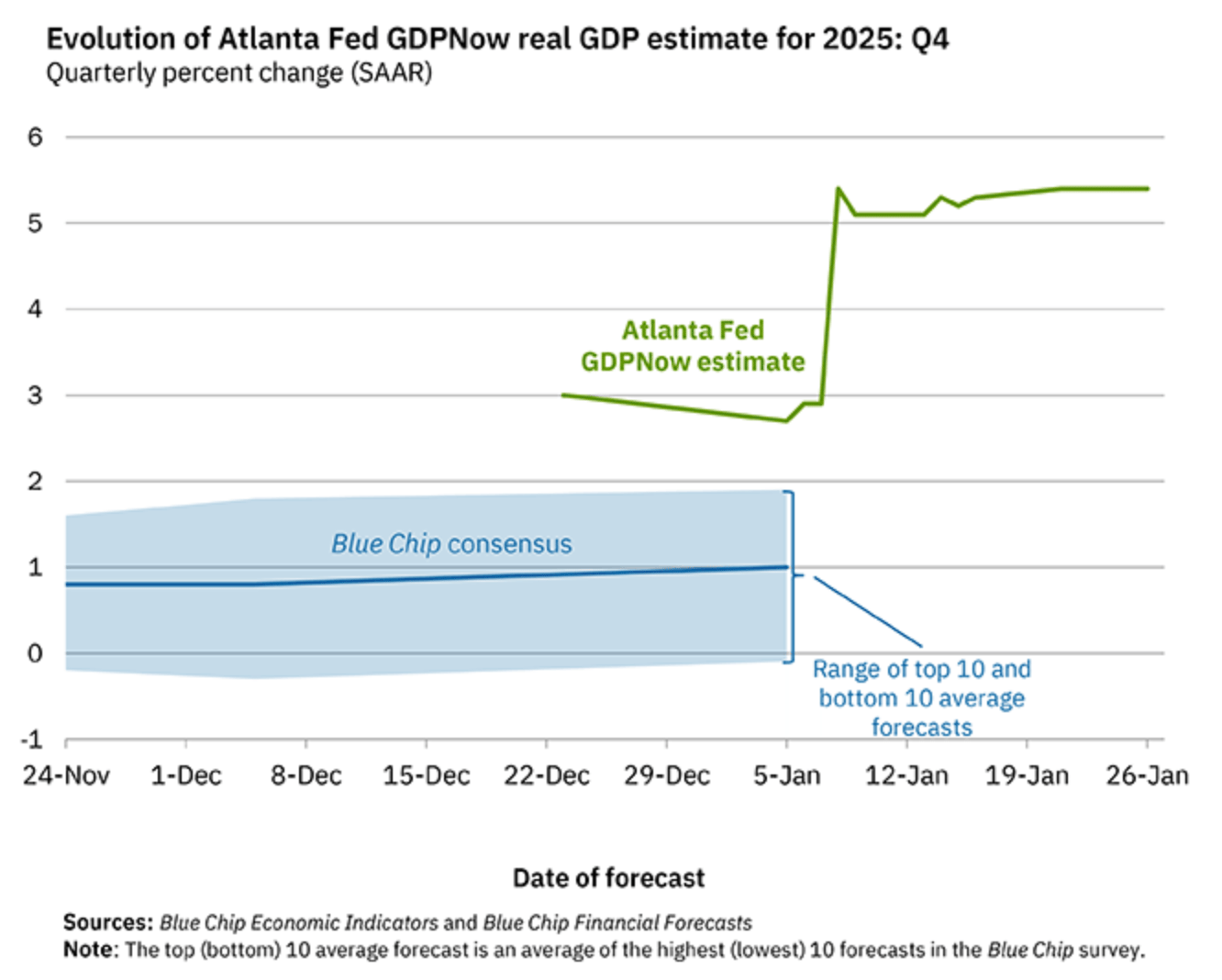

The most striking figure this month came from the Atlanta Fed’s GDPNow model, which estimated fourth-quarter (Q4 2025) growth at a staggering 5.4%.

Source: Atlanta Fed’s GDP Now forecast https://www.atlantafed.org/cqer/research/gdpnow

While "nowcasts" are notoriously volatile, this suggests that the U.S. consumer did not pull back as much as expected during the political and fiscal uncertainties of the previous fall. For SMBs, this is a double-edged sword: high growth usually means strong sales, but it also gives the Fed permission to keep interest rates "higher for longer" to prevent the economy from boiling over.

Said simply: This vertical climb (green line in chart above) is what gives the Fed "permission" to keep interest rates high—they aren't worried about a recession right now; they're worried about the engine running too hot.

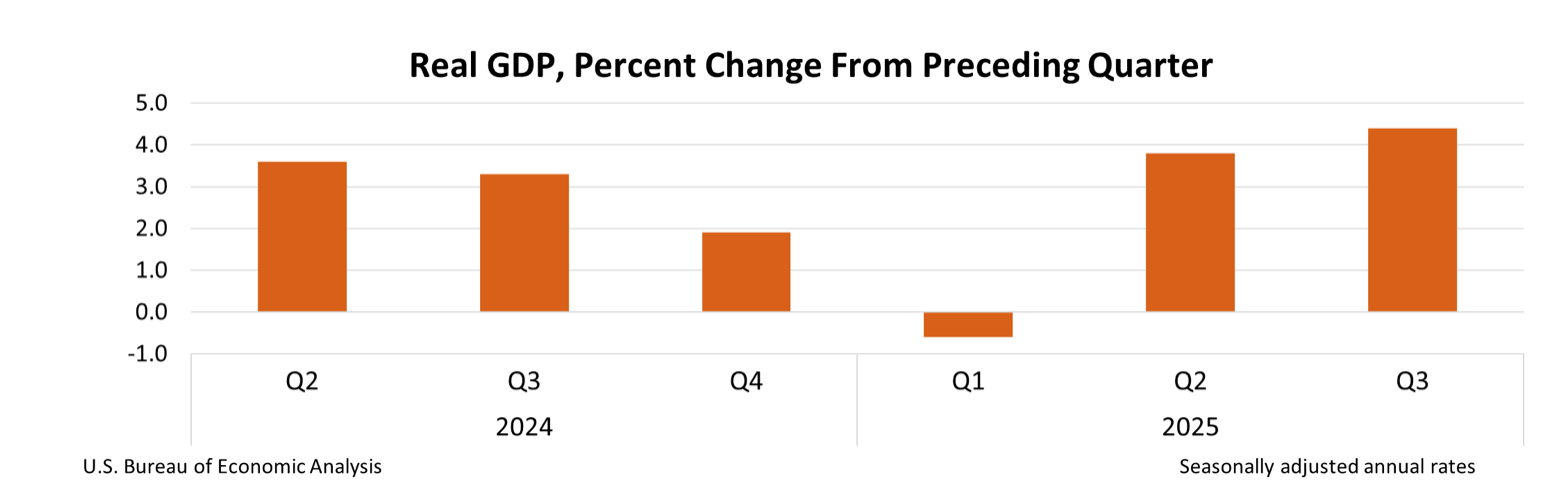

If you are not convinced where this is coming from, take a look below at these two revised updates on GDP growth. The first chart below shows Real GDP from Q3 2025. Real GDP adjusts for inflation (whereas nominal GDP does not). The 4.4% increase is a total net contribution of growth in percentage points across all the sectors listed in the chart below. Unsurprisingly, federal government is showing a contraction. Also, unsurprisingly information sector is witnessing an expansion - thanks to the continued AI boom, also expansion due to financing needs to keep up with the voracious capital investment needs (funded by second line), and tech adjacent industries (supported by third line). For more info see the BEA (Bureau of Economic Analysis) page here.

Source: Bureau of Economic Analysis (BEA)

This chart below shows the continued quarter over quarter growth in real GDP and drives home the point why the Fed is not yet convinced on bringing the interest rates down.

Source: Bureau of Economic Analysis

On the inflation front, the Personal Consumption Expenditures (PCE) index—the Fed’s favorite yardstick—showed that prices rose 2.8% year-over-year through November. Core inflation, which strips out the volatile food and energy costs we all deal with at the pump and the grocery store, remained equally stubborn at 2.8%. This is still well above the 2.0% goal, reinforcing the likelihood that the Fed will opt for a "pause" at the conclusion of their January 27–28 meeting tomorrow.

For a business generating $1M+ in revenue, these macro signals translate into very specific micro pressures.

Cash Flow & Borrowing: The current Federal Funds Rate sits in the 3.50% to 3.75% range. Because the January data shows persistent inflation, the "cheap money" we hoped for in Q1 is likely delayed. If you were planning to refinance debt or take out a new equipment loan, you are likely looking at mid-to-late 2026 before seeing another meaningful dip in prime rates.

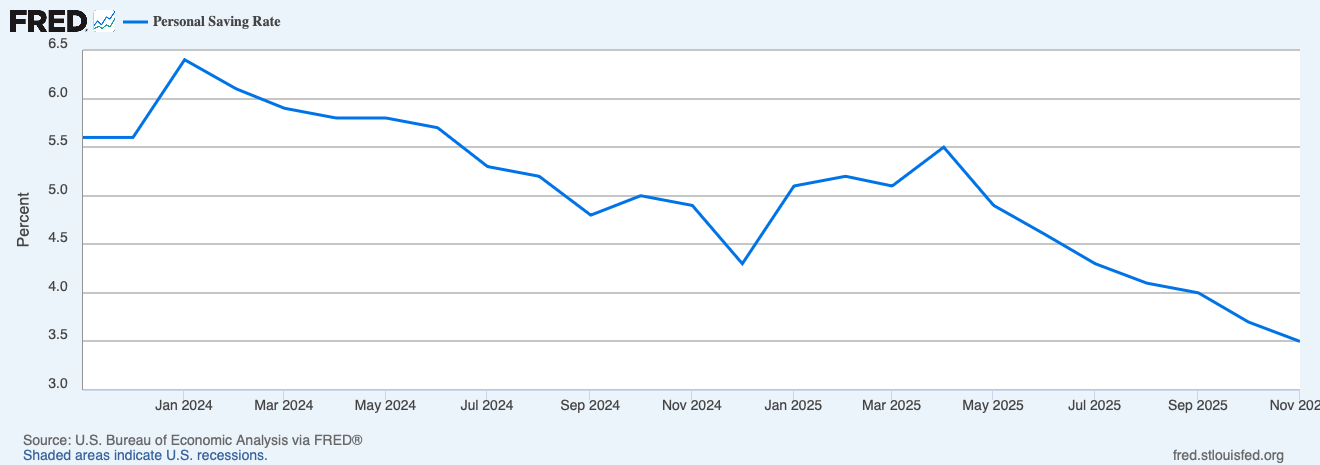

Customer Impact: Resilience in GDP suggests consumers still have money to spend, but the low personal savings rate (currently at 3.5%) indicates they are dipping into reserves. Demand may stay steady for now, but the "buffer" for a price increase for SMBs is thinner than it was a year ago. See the chart below from the Fed Reserve. This is a slippery slope - consumer personal savings are stepping down, and see how this squarely contradicts with the GDP growth above? The way I think about this - It’s not like it’s good times and that is why we are spending. We are spending at our own peril. All the more reason, the Fed is watching closely before taking any measures on easing.

Source: Federal Reserve Bank of St. Louis

Risk & Control: The primary risk right now is "Fed Independence." With political cycles and trade discussions (including the "return of tariffs") dominating the headlines, the Fed is moving with extreme caution to avoid appearing reactionary. This means sudden, helpful rate drops are unlikely; stability even at a higher cost is the current priority.

The data released so far in January 2026 reflects a transition from the "soft landing" hopes of 2025 into a "stagnant-but-stable" 2026.

Labor Market: The December Employment Situation (released Jan 9) showed that while job creation has slowed from the 200,000+ per month levels of 2024 to roughly 50,000 to 70,000 today, the unemployment rate remains steady at approximately 4.5%. This is what economists call a "jobless growth" environment. Productivity is up, and hiring is cautious.

Interest Rates: Goldman Sachs and Vanguard are both projecting only one to two rate cuts for the entirety of 2026, likely not starting until June. The market had previously priced in more aggressive easing, meaning the "higher rate for longer" narrative is back.

Mortgage & Credit: Despite the Fed's caution, 30-year mortgage rates have hovered around 6.09% this month.This is a three-year low, providing a small silver lining for those in the real estate or construction sectors.

Practical Takeaways

Hold the Line on Refinancing: If you can wait until the second half of the year to restructure significant business debt, do so. The data suggests the Fed wants to cut, but they need two or three more months of sub-2.5% inflation data to justify it.

Efficiency Over Expansion: With the labor market in a "jobless growth" phase, focus on optimizing your current team’s output. High GDP with low hiring suggests that technology and better workflows are driving the current wins.

Watch the "Tariff Pass-Through": If your supply chain involves international goods, start modeling 5–10% cost increases now. The Fed is explicitly watching how trade policy will impact domestic prices in Q1 and Q2.

Stress-Test Your Pricing: With the personal savings rate at a multi-year low, consumers have less of a safety net. Before raising prices, SMBs should stress test their brand and products’ value perception is high enough to prevent churn in a low-savings environment. Consider baking in consumer surveys.

So, if interest rates remain exactly where they are for the next nine months, how might you plan your capital expenditures?

If this was useful - subscribe to get clear, no‑hype briefings on the economy, markets, and AI for SMBs like this every week.